Homeowners with significant equity often face the dilemma of accessing those funds. A credit union home equity loan offers one solution, but navigating the process requires understanding interest rates, loan terms, and eligibility requirements. These loans can be beneficial for debt consolidation or home improvements, but they also carry risks if not managed responsibly.

Toc

- 1. Understanding Home Equity and Credit Union Loans for Debt Consolidation

- 2. Credit Union Home Equity Loan Rates and Requirements for Debt Consolidation

- 3. Related articles 01:

- 4. Understanding the Application Process

- 5. Utilizing a Home Equity Loan Calculator for Debt Consolidation Planning

- 6. Tax Implications of Home Equity Loans Used for Debt Consolidation

- 7. Successfully Consolidating Debt with a Credit Union Home Equity Loan

- 8. Home Equity Line of Credit (HELOC) Rates: An Overview

- 9. Conclusion

- 10. Related articles 02:

Understanding Home Equity and Credit Union Loans for Debt Consolidation

Home equity represents the portion of your home that you own outright. It is determined by subtracting your mortgage balance from your home’s current market value. For example, if your home is valued at $300,000 and your mortgage balance is $200,000, your home equity stands at $100,000. This equity can be leveraged for various financial needs, including debt consolidation.

What Is a Home Equity Loan?

A home equity loan is a type of loan where the borrower uses the equity of their home as collateral. This means that the amount you can borrow is based on the value of your home and the amount you still owe on your mortgage. A credit union home equity loan allows you to borrow a lump sum of money at a fixed interest rate, which you then repay over a set period, typically ranging from five to fifteen years.

Why Choose a Credit Union for a Home Equity Loan?

Credit unions offer unique advantages over traditional banks when it comes to home equity loans. They often feature lower interest rates and a more personalized approach to customer service, thanks to their member-focused structure. This can be particularly beneficial for homeowners looking to consolidate high-interest debt, as lower rates can significantly reduce the total cost of borrowing.

Moreover, the not-for-profit nature of credit unions means that they often have lower overhead costs than for-profit banks. This translates into lower interest rates and fewer fees for members. Credit unions prioritize the financial well-being of their members, making them an attractive option for those seeking a home equity loan.

Furthermore, credit unions typically have a more flexible approach to lending, which can be advantageous if you have less-than-perfect credit. They are often willing to work with you to find a solution that fits your financial situation.

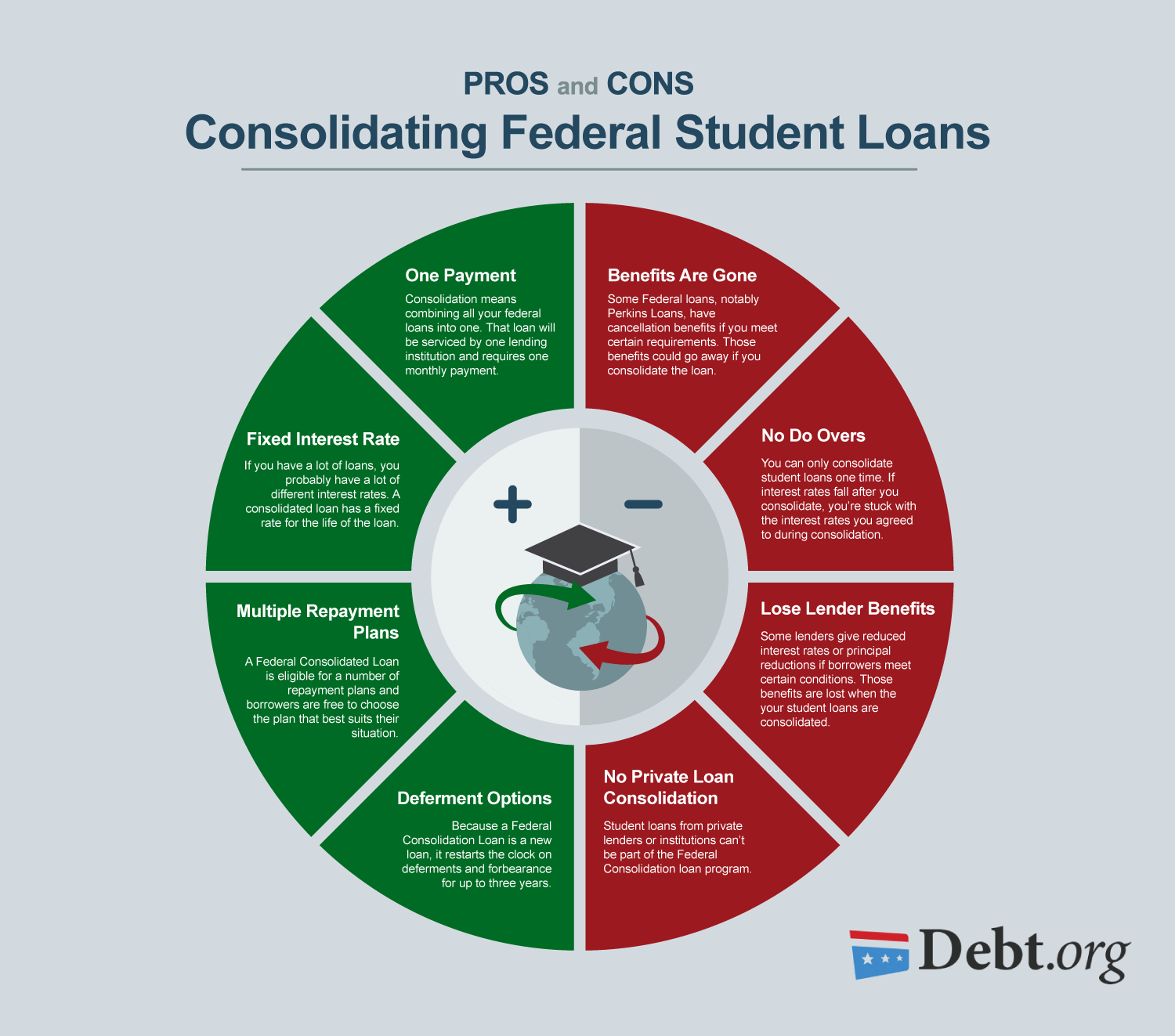

Comparing Home Equity Loans and HELOCs

When considering debt consolidation, it’s essential to understand the differences between a credit union home equity loan and a home equity line of credit (HELOC). A home equity loan provides a lump sum with a fixed interest rate, while a HELOC functions more like a credit card, offering a revolving line of credit with variable interest rates. The table below highlights the differences between the two options, particularly in the context of debt consolidation:

| Feature | Home Equity Loan | HELOC |

|---|---|---|

| Loan Structure | Lump sum payment | Revolving credit |

| Interest Rate | Fixed | Variable |

| Repayment Terms | Fixed monthly payments | Flexible payments |

| Ideal for | Specific projects | Ongoing expenses |

Choosing between these options depends on your financial needs and preferences. A home equity loan might be ideal for a one-time expense, while a HELOC can provide ongoing access to funds as needed. However, it’s important to note that while HELOCs offer flexibility, they carry the risk of variable interest rates that can increase significantly over time, potentially leading to higher overall costs than a fixed-rate home equity loan.

Credit Union Home Equity Loan Rates and Requirements for Debt Consolidation

When exploring credit union home equity loan rates, several factors come into play, including your credit score, loan-to-value ratio, and current market conditions. Typically, borrowers with higher credit scores and lower loan-to-value ratios are eligible for more favorable rates.

Current Trends in Home Equity Lending

The landscape of home equity lending is continuously evolving. Recent volatility in interest rates, driven by actions from the Federal Reserve, has impacted both home equity loans and HELOCs. As rates fluctuate, borrowers may find it advantageous to act quickly to secure favorable terms.

Additionally, there is a growing trend of online lenders entering the home equity loan market. These online platforms often offer competitive rates and a streamlined application process, challenging traditional credit unions and banks. Homeowners should consider all their options, including both traditional and online lenders, when seeking a home equity loan.

As of December 2024, average rates for credit union home equity loans may range from 6% to 8%, according to [Source]. However, it’s crucial to check with your specific credit union for the most accurate rates, as they can fluctuate.

Factors Influencing Credit Union Home Equity Loan Rates

- Credit Score: A higher credit score often leads to lower interest rates. Lenders view individuals with good credit as less risky.

- Loan-to-Value Ratio (LTV): This ratio compares the amount of your loan to the appraised value of your home. A lower LTV ratio typically results in better rates.

- Current Market Conditions: Interest rates can fluctuate based on economic factors and the Federal Reserve’s monetary policy.

- Loan Amount and Term: The amount you borrow and the duration of the loan can also impact your interest rate.

Understanding the Credit Union Home Equity Loan Requirements

Understanding the credit union home equity loan requirements is equally important. Common criteria include:

- Minimum Credit Score: Most credit unions require a minimum credit score, often around 620. Some may offer loans to those with lower scores, but at higher rates.

- Debt-to-Income Ratio: A favorable debt-to-income ratio is essential, as it demonstrates your ability to repay the loan. Most credit unions prefer a ratio of 43% or lower.

- Property Appraisal: A professional appraisal of your property is usually necessary to determine its current market value. This ensures that the loan amount does not exceed the value of the home.

It’s important to note that while credit unions often offer lower rates, they might have stricter lending criteria than some banks, potentially excluding borrowers with slightly lower credit scores. Familiarizing yourself with these requirements can streamline your application process. Generally, loan amounts for credit union home equity loans can range from $10,000 to $100,000 or more, with repayment terms typically spanning five to fifteen years.

Understanding the Application Process

Selecting the right lender is a critical step in securing a credit union home equity loan. Before diving into the specifics of lender selection, it’s important to understand the application process.

Tips for Choosing the Best Credit Union Home Equity Loan Lender

- Research Online: Look for reviews and ratings of credit unions in your area. Websites like Yelp and Google Reviews can provide insights into member experiences.

- Evaluate Financial Stability: Check the credit union’s financial health through ratings from agencies like BauerFinancial or the National Credit Union Administration (NCUA).

- Compare Services Offered: Some credit unions may offer additional services such as financial counseling or debt management resources that can be beneficial.

- Inquire About Fees: Be aware of any fees associated with the loan, including origination fees, appraisal fees, and closing costs.

- Ask About Pre-Qualification: Many credit unions offer a pre-qualification process that allows you to assess your eligibility without affecting your credit score.

To illustrate how lending requirements can vary, let’s consider the Navy Federal home equity loan requirements. Navy Federal may have specific criteria, such as a minimum credit score or maximum loan-to-value ratio, which could differ from those of other credit unions. This comparison can help you identify the best fit for your needs.

Once you’ve selected a credit union, the pre-qualification process typically involves submitting financial information for a preliminary review. After pre-qualification, you can proceed with the full application, which will require detailed documentation regarding your income, assets, and property. It’s advisable to compare offers from multiple lenders to secure the best credit union home equity loan rates.

Utilizing a Home Equity Loan Calculator for Debt Consolidation Planning

A home equity loan calculator can be an invaluable tool for estimating your potential monthly payments and total interest paid over the life of the loan. To use a credit union home equity loan calculator effectively, you should input key information such as the loan amount, interest rate, and loan term.

How to Use a Home Equity Loan Calculator

Here’s a simple guide to using the calculator:

- Enter the Loan Amount: Input the amount you wish to borrow.

- Set the Interest Rate: Use the current average rate or the rate offered by your credit union.

- Choose the Loan Term: Select the duration over which you plan to repay the loan, typically between five to fifteen years.

The calculator will generate outputs, including your estimated monthly payment, total interest paid, and total cost of the loan. Understanding these results can empower you to make an informed decision about whether a credit union home equity loan aligns with your financial objectives.

Why Use a Home Equity Loan Calculator?

Using a home equity loan calculator helps you:

- Budget Accurately: Knowing your monthly payment can help you plan your budget more effectively.

- Compare Loan Options: You can adjust the loan amount and interest rate to see how different scenarios affect your payments.

- Understand Total Costs: Calculating total interest paid over the life of the loan can provide insight into the true cost of borrowing.

Tax Implications of Home Equity Loans Used for Debt Consolidation

Tax considerations play a crucial role when contemplating a credit union home equity loan for debt consolidation. Depending on how you utilize the loan proceeds, the interest paid may be tax-deductible. The IRS allows deductions for interest on loans used to buy, build, or substantially improve a home. However, it is advisable to consult with a tax advisor to understand the specific implications and any limitations that may apply.

Maintaining Accurate Records for Tax Purposes

Maintaining accurate records of your loan payments and interest paid is essential for tax purposes. Being organized can help you take full advantage of any potential deductions when tax season arrives. Here are some tips:

- Keep Loan Documentation: Store all documents related to your loan, including the loan agreement and payment history.

- Track Interest Payments: Maintain a record of how much interest you pay each year to support your tax deduction claims.

- Consult a Tax Professional: Engage a tax advisor to ensure you are maximizing your deductions and complying with IRS regulations.

Successfully Consolidating Debt with a Credit Union Home Equity Loan

Utilizing a credit union home equity loan for debt consolidation can be a smart financial strategy. By consolidating high-interest debt, you can simplify your payments and often secure a lower interest rate, saving money in the long run. However, it’s crucial to understand the risks involved, such as the potential for accumulating more debt if spending habits do not change.

Strategies for Effective Debt Consolidation

To successfully consolidate debt, consider these strategies:

- Create a Budget: Ensure you have a clear budget that allows for the repayment of the new loan without incurring additional debt.

- Use Funds Wisely: Direct the loan proceeds exclusively toward paying off high-interest debts.

- Avoid New Debt: Resist the temptation to accumulate additional debt while repaying the loan.

- Set Up Automatic Payments: Automate your loan payments to avoid missing due dates and incurring late fees.

By following these strategies, you can effectively manage your debt and leverage your credit union home equity loan to improve your financial situation.

Home Equity Line of Credit (HELOC) Rates: An Overview

A home equity line of credit (HELOC) offers a flexible borrowing option that is particularly useful for ongoing expenses or projects with uncertain costs. Unlike a traditional home equity loan, which provides a lump sum, a HELOC gives you access to a revolving line of credit with variable interest rates. This can be beneficial for homeowners looking to manage costs over time.

Understanding HELOCs in the Context of Debt Consolidation

When considering a HELOC for debt consolidation, it’s important to understand how it differs from a traditional home equity loan:

- Flexibility: A HELOC allows you to withdraw funds as needed, making it ideal for ongoing expenses.

- Variable Rates: While HELOCs can offer lower initial rates, they are subject to change, which can impact your monthly payments.

- Payment Structure: With a HELOC, you may only need to make interest payments during the draw period, which can be appealing but may lead to larger payments later on.

It’s essential to weigh the differences between a HELOC and a home equity loan carefully. While HELOCs offer flexibility, they also come with risks associated with variable interest rates that can change based on market conditions, potentially increasing your overall costs.

Conclusion

This article provided a comprehensive guide to obtaining a credit union home equity loan for debt consolidation. By understanding the rates, requirements, current trends, and potential tax implications, you can make an informed decision. Remember to compare offers from multiple lenders, utilize a home equity loan calculator, and create a realistic budget to ensure successful debt consolidation.

As the lending landscape evolves, staying informed about market trends and understanding the nuances of credit union home equity loans will empower you to make sound financial decisions. Contact your local credit union today to begin the process and explore your options for lower interest rates and a simpler financial future.